I’ve just hit the age of 30. I started thinking about long-term future and thus looking into investment opportunities sometime last year (2016). My first thought was – stocks. That’s how people do it, that’s how people get rich, right? After watching The Big Short a couple of times I bought the book and finished reading it in just 18 days (I’m a very slow reader, mind you!) which was a sort of a record for me. The book had several references to other books of the financial world and thus I ended up buying Benjamin Graham’s Intelligent Investor in December. Although I have not yet finished reading it (like I said – a very slow reader), the book feels like the holy grail. Maybe because I have no financial background whatsoever so almost everything in there is new to me. While reading I realized – stocks is not the way. Bummer, eh?

Around the same time I got into business of contemplating about investing, by coincidence I had to go over an assignment contract of a p2p platform (from the point of view of a loan originator). I knew nothing about p2p lending at the time but it sounded captivating. The loan originator decided to place their loans on the platform. Later I found out that their loans (worth about 1,5 million euros) were fully invested in in a mere week or so. That meant the market is huge. I decided to give it a try.

I’m not rich, I’m not very knowledgeable about finances or investing. I am basically experimenting to see whether it is possible (for myself) to reach financial freedom in the next two decades. And I have started with p2p platforms. My investments are small but they are regular and slowly growing. I’m very wary of where I’m putting my money and I’m not willing to take big risks. Graham says it’s a good thing. I sure hope so.

Since the beginning of this year (2017) I have tested four p2p platforms – Mintos, Twino, Viainvest and doFinance. Just yesterday I opened an account with Omaraha (Finzo).

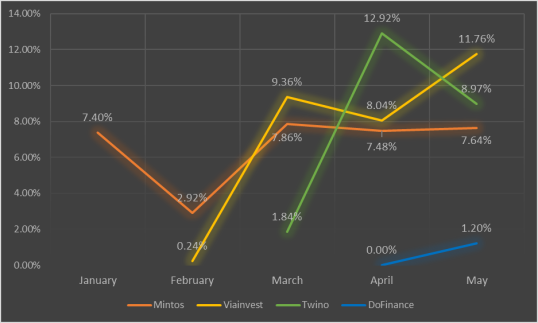

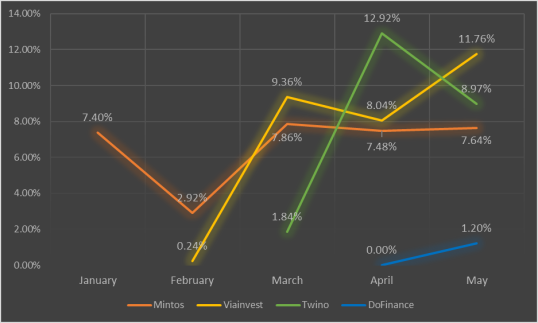

The results thus far.

The numbers may not be quite accurate as I haven’t taken into account the fact that, for example, I keep adding funds to Mintos on a monthly basis (hence the % is lower – the newly invested funds make returns only next month) while Twino had a lump-sum sitting around for three months (hence it appears to be the most profitable in April). I also haven’t taken into account reinvested funds. That is, I only account for the funds that were actually transferred from my bank account (“real funds”). If I stumble upon an elaborate formula I can use to calculate my returns more precisely, I’ll use that. Until then – simple excel and simple formula it is:

total income for the month / total “real funds” on the platform x 12

Mintos saw a drop in February which was due to the fact that I was experimenting with secondary market and incurred some fees.

doFinance is not bringing in much (or anything) yet because I invested only a small portion of the funds in the short-term (1 & 2 month) loans. The bulk went into 6 month loans there as the interest on those is promised to be 12%.

Viainvest has worked like a charm thus far. What makes them different is that they withhold applicable taxes upon transferring interest into investor’s account. So (I hope) I will not have to pay a dime more.

After testing Twino for 3 months I decided to exit Twino altogether. This is why – a) they don’t have enough new loans coming in; b) my user-experience with their webpage was horrible. I couldn’t get used to it. Things that I was looking for were not where I expected them to be so that was just frustrating; c) their loans seem to be quite shady – this is the only platform where I have 3 loans marked as “defaulted”. All of those were issued for 24 months and all of those only made 2 repayments; d) too often I’ve seen “delayed” in red letters. Even today – I just witnessed a few dozen loans popping up on the platform and all of them are already showing up “delayed”. I don’t get their strategy.

Browsing through the web last night I also stumbled upon a few posts and comments here and there about either withdrawing from Twino or rumoring about some sort of business troubles on their end. Rumors or not, but that just added to my resolution. I wish them luck. Once they rework their webpage and make it more intuitive and thus more user-friendly as well as offer a continuous supply of “current” investment opportunities I may just as well return. Their “Payment Guarantee” feature was a nice addition in my view and presumably one that will get picked up by other platforms sooner or later. Unfortunately due to PG loans that I had invested in showing up as “defaulted” I’m also unable to sell them and withdraw funds immediately. I surely hope Twino keeps on going for at least a year so I can get all my investments back 🙂