Last month continued to show good returns across the board. All Robocash investments (5) were late and got bought back so I still haven’t invested anything more than my initial investment and most probably won’t invest more for the foreseeable future.

I still support my decision to withdraw from Twino. It has a short period of many loans listed and then we return to the usual emptiness. And their webpage is experiencing some loading issues recently.

Unfortunately Viainvest saw a complete drop in loans from Czech Republic and Spain, instead currently it only offers loans from Poland which come with a lower return of 10% (Spain and Czech loans were up to 12.2%). They haven’t announced anything as to why they are listing only Polish loans. At least I’m not aware of such an announcement.

At the very end of July Mintos announced that they are changing the way Lendo loans will be listed on the platform. Instead of Lendo listing the loans directly, Mintos OU will issue loans to Lendo instead and this loan from Mintos OU will therefore be listed on the platform. They announced that loans issued by Mintos OU will be “pegged” to loans issued to consumers by Lendo. However it is not clear at all how they are going to “peg” a loan to another loan. They failed to provide a clear answer in the comment section of their blog once an investor raised this concern. The fact that instead of buying from Lendo the loans issued to consumers and then selling them to investors on the platform (which, in my opinion, is the more straightforward approach), Mintos OU chose a dubious path of “pegging” loan to another loan. I don’t know how this setup is going to work if there are any problems on part of Lendo or Mintos OU. I have not had enough time to read through their agreements yet. Once I do, it may shed more light on this shady deal.

Nothing to say about DoFinance. Everything works as expected. By far the most consistent performance. They did send a welcome gift in July – a pen and a letter 🙂 presumably to every investor. A small but very neat gesture, a sort of a personal touch of the owners. Very neat indeed.

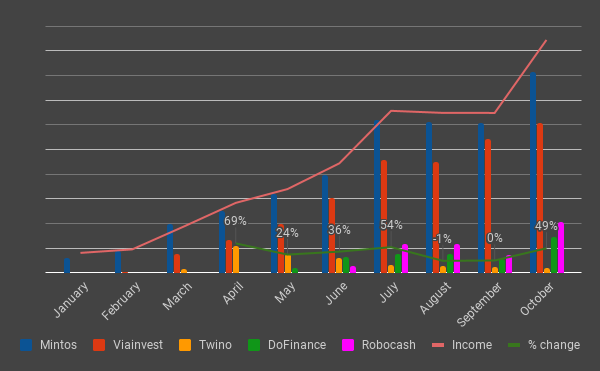

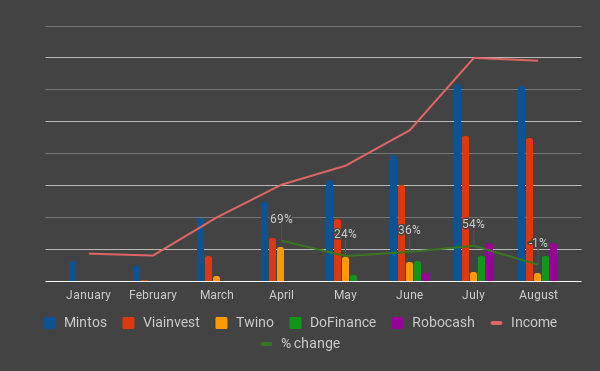

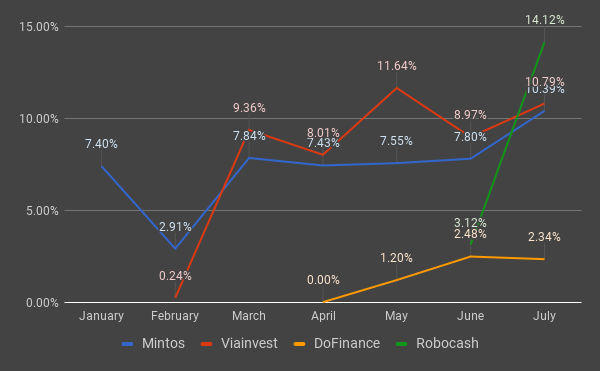

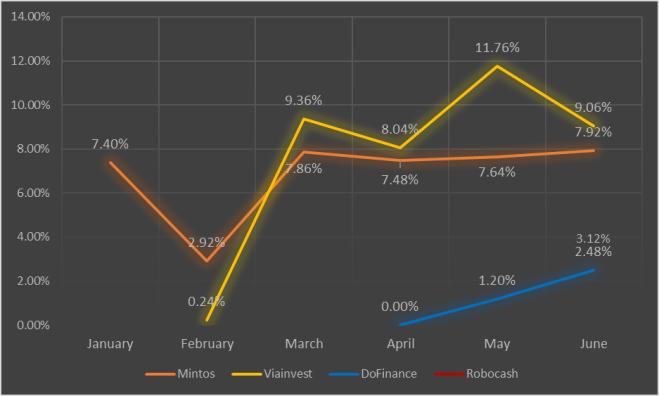

Now the stats part. I switched to google sheets so the editing is simpler from anywhere in the world.

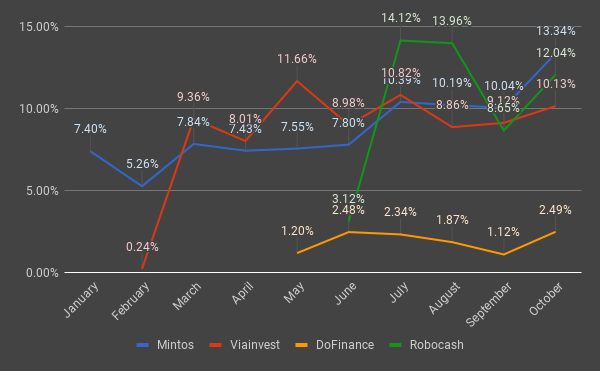

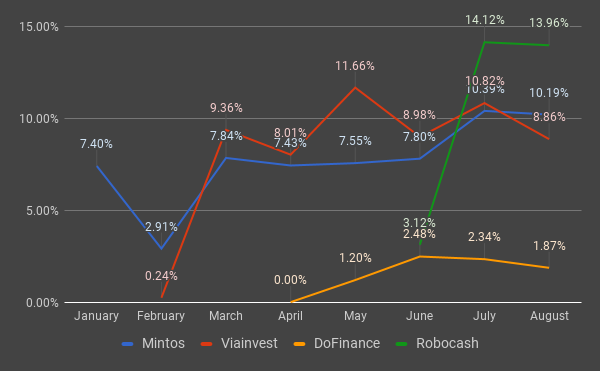

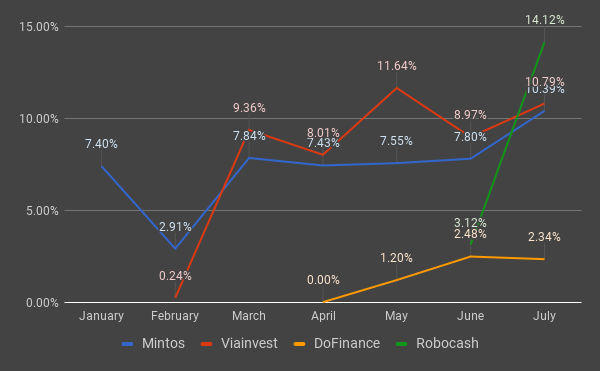

Mintos showed a sudden spike in performance but I didn’t notice anything that could have triggered it. I suppose more loans matured in this period than before. Robocash seemingly skyrocketed but they do promise 14% return on their loans and that’s what they deliver. Viainvest keeps showing more or less consistent performance. And most loans of DoFinance have not matured yet. The first 12% loans are due to mature in October.

I also slightly changed the formula I use for calculating returns. Now it takes into account the fact that the returns are being reinvested:

total income for the month / total funds (including returns) on the platform x 12

The change though did not have a big impact on overall statistics.

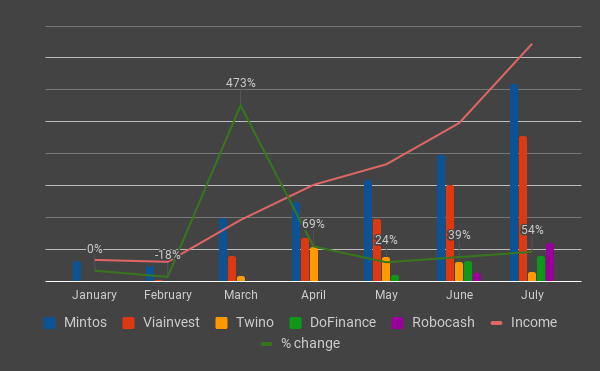

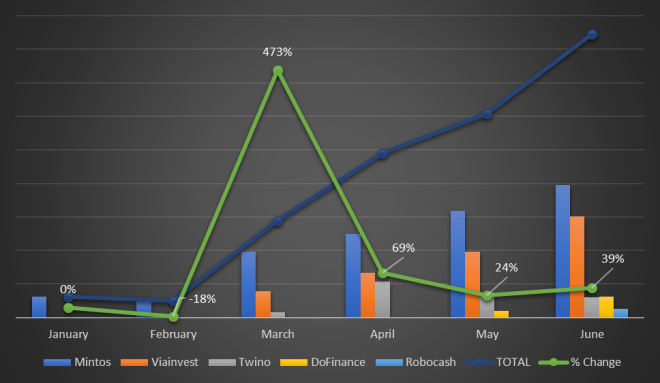

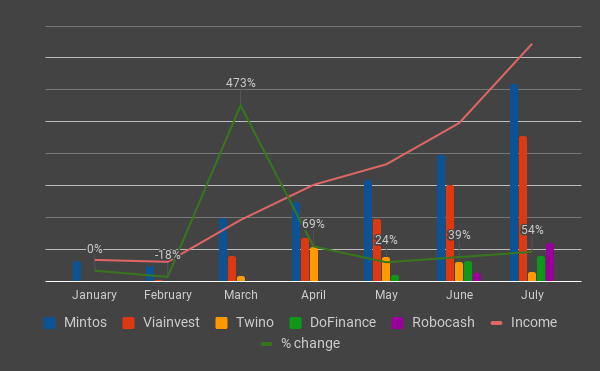

A consistent growth. Most of it due to the fact that I keep adding funds to platforms 🙂 July saw me adding funds to Mintos, Viainvest and DoFinance.

In order to make this chart “cleaner”, I’m contemplating about removing the weird stats of March showing an increase of 473%. Which of course is a “technical” (maths rather) issue rather than actual returns.

As to my idea of ETFs – I did not quite get to the bottom of it. I found a cheap broker offer from Ireland, but unfortunately they do not accept bank accounts from my domicile. So I shall keep looking.

Sidenote – I recently came across a new abbreviation “FIRE” of already known notion of early retirement. Financially Independent and Retiring Early. Shall read more about it.